With Small Business Health Insurance for Startups: Top 5 Providers at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

Small business health insurance plays a crucial role in providing financial security and peace of mind to startup employees. Understanding the top providers in the market can help startups make informed decisions that benefit both the company and its staff.

Overview of Small Business Health Insurance for Startups

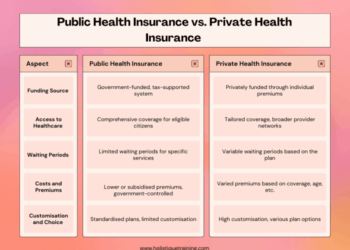

Small business health insurance is a type of health coverage offered to employees of small businesses, including startups. It is important for startups to provide health insurance as it helps attract and retain top talent, promotes employee well-being, and boosts overall productivity.Key Differences from Individual Plans

Small business health insurance differs from individual plans in several ways. While individual plans are purchased by individuals for themselves and their families, small business health insurance is typically purchased by the employer for their employees. This allows small businesses to leverage group rates and offer more comprehensive coverage options to their employees. Additionally, small business health insurance often comes with added benefits such as wellness programs and preventive care services.Benefits of Offering Health Insurance to Employees

- Attracting Top Talent: Offering health insurance can make your startup more attractive to potential employees, helping you recruit and retain top talent in a competitive market.

- Employee Well-Being: Providing health insurance shows that you care about your employees' well-being, leading to higher job satisfaction and lower turnover rates.

- Productivity and Morale: Healthy employees are more productive and engaged at work, leading to a positive work environment and increased morale among team members.

- Tax Benefits: Small businesses may be eligible for tax credits or deductions for providing health insurance to their employees, helping offset the costs of coverage.

- Legal Compliance: Depending on the size of your startup, you may be required by law to offer health insurance to your employees to comply with regulations such as the Affordable Care Act.

Top 5 Providers of Small Business Health Insurance

When it comes to choosing a health insurance provider for your startup, it's essential to consider the offerings, coverage, and costs of each option. Here are the top 5 providers in the market that cater to small businesses:1. Blue Cross Blue Shield

Blue Cross Blue Shield is a well-known provider that offers a wide range of health insurance plans for small businesses. They are known for their extensive network of healthcare providers and comprehensive coverage options. While their premiums may be slightly higher compared to other providers, they are known for their excellent customer service and support.2. Aetna

Aetna is another popular choice for small business health insurance. They offer a variety of plan options, including HMOs, PPOs, and high-deductible health plans. Aetna is known for its competitive pricing and strong network of healthcare providers. They also provide wellness programs and resources to help employees stay healthy.3. UnitedHealthcare

UnitedHealthcare is a leading provider of health insurance for small businesses. They offer a range of plan options, including customizable plans to fit the specific needs of your business. UnitedHealthcare is known for its innovative health and wellness programs, as well as its strong customer service.4. Cigna

Cigna is another top provider of small business health insurance. They offer a variety of plan options, including health maintenance organization (HMO) plans and preferred provider organization (PPO) plans. Cigna is known for its affordable premiums and comprehensive coverage options.5. Kaiser Permanente

Kaiser Permanente is a unique provider that offers both health insurance and healthcare services under one roof. They are known for their integrated approach to healthcare, which can lead to better coordination of care for employees. Kaiser Permanente offers a range of plan options and is known for its focus on preventive care.Considerations for Startups When Choosing Health Insurance

Factors to Consider When Choosing Health Insurance

- Cost: Evaluate the cost of premiums, deductibles, and copayments to ensure that the plan is affordable for your startup.

- Coverage: Look into the coverage options provided by different insurers, including in-network providers, prescription drug coverage, and preventive care services.

- Flexibility: Consider the flexibility of the plans offered, such as the ability to add or remove coverage options based on your startup's changing needs.

- Network: Check the network of healthcare providers included in the plan to ensure that your employees have access to quality care.

- Customization: Work with insurers to customize a plan that meets the specific needs of your startup and employees, whether it's through different coverage levels or wellness programs.

Tips for Startups to Save Costs on Health Insurance

Saving costs on health insurance premiums is crucial for startups looking to manage their expenses effectively. By implementing the right strategies and exploring alternative options, startups can find ways to reduce their healthcare costs without compromising on quality coverage.Cost-Sharing Options

- Consider high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) to lower premiums and save on taxes.

- Encourage employees to participate in cost-sharing arrangements like co-payments and coinsurance to distribute healthcare expenses more evenly.

- Explore Health Reimbursement Arrangements (HRAs) as a way to reimburse employees for out-of-pocket medical expenses while controlling costs.

Alternative Health Insurance Options

- Look into self-insurance or level-funded plans for startups with healthier employees to potentially lower premium costs.

- Consider telemedicine services to provide affordable and convenient healthcare options for employees, reducing the need for costly doctor visits.

- Shop around and compare quotes from different insurance providers to find the most cost-effective plan that meets your startup's needs.

Legal Requirements and Compliance for Small Business Health Insurance

When it comes to offering health insurance as a startup, there are legal obligations and regulations that must be followed to ensure compliance with state and federal laws. One of the key pieces of legislation that impacts small businesses is the Affordable Care Act (ACA), which sets requirements for employers offering health insurance to their employees.Affordable Care Act (ACA) Requirements for Small Businesses

- Under the ACA, small businesses with 50 or more full-time employees are required to offer health insurance to their employees or face potential penalties.

- The ACA mandates that health insurance plans offered by small businesses must meet certain minimum standards for coverage and affordability.

- Small businesses may be eligible for tax credits if they offer health insurance that meets the ACA requirements.

Ensuring Compliance with State and Federal Laws

- Startups should familiarize themselves with the specific health insurance laws in the states where they operate, as requirements can vary.

- It is crucial for startups to stay informed about any changes to federal regulations that may impact their health insurance offerings.

- Consulting with legal and insurance professionals can help startups navigate the complex landscape of health insurance regulations and ensure compliance.

Outcome Summary

In conclusion, exploring the landscape of Small Business Health Insurance for Startups: Top 5 Providers offers startups valuable insights into navigating the complexities of healthcare options. By choosing the right provider, startups can prioritize the well-being of their employees while strengthening their business foundation.

Popular Questions

What sets small business health insurance apart from individual plans?

Small business health insurance typically offers group coverage to employees, often at lower costs compared to individual plans. It allows small businesses to provide comprehensive health benefits to their staff.

How can startups customize health insurance plans to suit their needs?

Startups can tailor health insurance plans by choosing specific coverage options, adjusting deductibles, and exploring add-on benefits. This customization ensures that the plan aligns with the startup's budget and employee requirements.

What legal requirements do startups need to follow when offering health insurance?

Startups need to comply with various regulations including the Affordable Care Act (ACA) requirements, state laws, and federal mandates. Ensuring legal compliance is essential to avoid penalties and provide adequate coverage to employees.