Delving into the comparison of Employee Health Insurance and Private Insurance, this introduction sets the stage for an insightful discussion on the advantages and disadvantages of each, guiding readers through a comprehensive analysis.

Providing a detailed overview of the coverage, costs, and customization options, this intro aims to engage readers from the start, shedding light on the complexities of choosing the right insurance plan.

Employee Health Insurance

Employee health insurance is a type of coverage provided by employers to their employees as part of their benefits package. This insurance helps cover medical expenses and can include a variety of services depending on the plan.Coverage Provided

Employee health insurance plans typically cover a range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care. Some plans may also include dental and vision coverage.Advantages and Disadvantages

- Advantages:

- Often more affordable than private insurance.

- Employer may contribute towards premiums.

- Can provide comprehensive coverage.

- Disadvantages:

- Limited choice of providers.

- Coverage may change if you change jobs.

- May have less flexibility in choosing coverage options.

Premiums, Deductibles, and Copayments

Employee health insurance plans typically require employees to contribute towards the cost of premiums, which are deducted from their paycheck. Deductibles are the amount you pay out of pocket before insurance kicks in, while copayments are set fees you pay for services like doctor visits or prescriptions.Common Providers

Some common providers of employee health insurance include:1. UnitedHealthcare

2. Blue Cross Blue Shield

3. AetnaEach of these providers offers a variety of plans with different coverage options and costs.

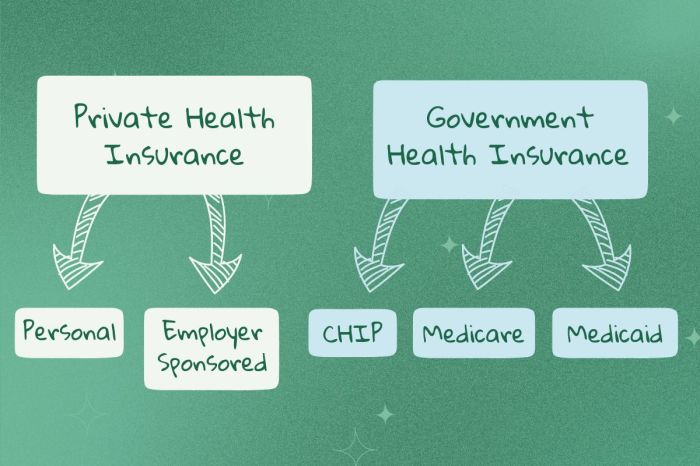

Private Insurance

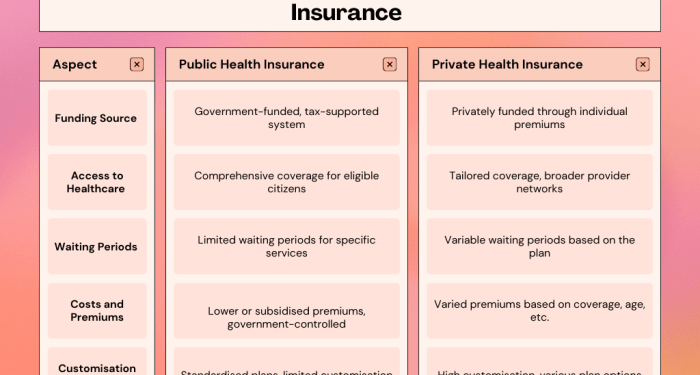

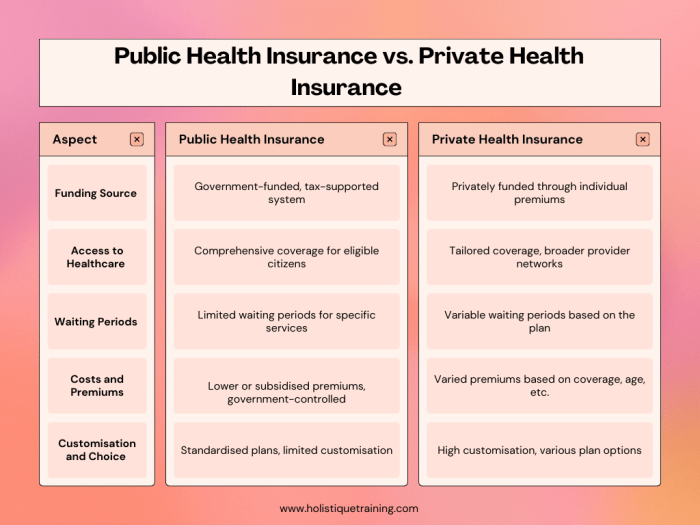

Private insurance offers individuals the flexibility and customization options to tailor their coverage to suit their specific needs and preferences. Unlike employee health insurance, private insurance plans can be personalized to include additional benefits or exclude services that may not be necessary for the individual.

Private insurance offers individuals the flexibility and customization options to tailor their coverage to suit their specific needs and preferences. Unlike employee health insurance, private insurance plans can be personalized to include additional benefits or exclude services that may not be necessary for the individual.Cost Comparison

When comparing the costs associated with private insurance to those of employee health insurance, it is essential to consider factors such as premiums, deductibles, copayments, and out-of-pocket expenses. Private insurance plans may offer a wider range of coverage options, but they can also be more expensive than employer-sponsored plans.Selection Process

Selecting a private insurance plan involves researching different providers, comparing coverage options, and evaluating costs. Factors to consider include network coverage, prescription drug coverage, out-of-pocket expenses, and customer service. It is crucial to assess individual healthcare needs and budget constraints when choosing a private insurance plan.Types of Private Insurance

Private insurance plans come in various forms, including individual plans, family plans, and group plans. Individual plans are designed for single policyholders, while family plans provide coverage for multiple family members. Group plans are typically offered through employers or associations and cover a group of individuals under one policy.Coverage and Services

Employee health insurance and private insurance differ in their coverage scope and services offered. Let's explore the key differences in terms of medical services, prescription drugs, mental health coverage, limitations/exclusions, pre-existing conditions, and additional services like wellness programs and telemedicine.Medical Services

- Employee Health Insurance: Typically covers a wide range of medical services including hospital stays, doctor visits, preventive care, and specialist consultations.

- Private Insurance: Offers similar coverage for medical services but may vary in terms of network providers and out-of-pocket costs.

Prescription Drugs

- Employee Health Insurance: Often includes coverage for prescription drugs, with varying copayments or coinsurance rates.

- Private Insurance: Prescription drug coverage may also be included, but the formulary and coverage levels can differ among plans.

Mental Health Coverage

- Employee Health Insurance: Many plans now offer mental health services, including therapy and counseling, as part of their coverage.

- Private Insurance: Mental health coverage may be included but can have limitations such as visit caps or higher out-of-pocket costs.

Limitations and Exclusions

- Employee Health Insurance: Some plans may have limitations on certain procedures or treatments, and exclusions for elective procedures or cosmetic surgery.

- Private Insurance: Exclusions can vary widely, including pre-existing conditions, experimental treatments, or specific medical services.

Pre-existing Conditions

- Employee Health Insurance: The Affordable Care Act prohibits discrimination based on pre-existing conditions, ensuring coverage for such conditions.

- Private Insurance: Pre-existing conditions may lead to higher premiums or exclusions, depending on the insurer and plan.

Additional Services

- Employee Health Insurance: Some plans may offer wellness programs, gym memberships, or discounts on health-related services as additional perks.

- Private Insurance: Wellness programs, telemedicine services, and other extras can vary among private insurance plans, often depending on the provider.

Network and Provider Options

When it comes to choosing between employee health insurance and private insurance, one key factor to consider is the network of healthcare providers available to you. Networks play a crucial role in determining the cost and coverage of your medical care.Network Size and Provider Choices

In the context of employee health insurance, the network typically consists of a select group of healthcare providers that have agreed to provide services at a discounted rate to employees covered by the plan. These networks are often more limited compared to private insurance plans.On the other hand, private insurance plans usually offer a wider range of provider choices, including access to prestigious hospitals and specialists. This greater flexibility in provider options can be appealing to individuals who prefer to have more control over their healthcare decisions.In-Network and Out-of-Network Care

Both types of insurance differentiate between in-network and out-of-network care. In-network care refers to services provided by healthcare providers who are part of the insurance plan's network. These services are typically covered at a higher rate and require lower out-of-pocket costs for the insured individual.Out-of-network care, on the other hand, involves services provided by healthcare providers who are not part of the insurance plan's network. This can result in higher out-of-pocket costs for the insured individual, as well as potential disputes over coverage and reimbursement.Examples of Healthcare Providers

Some well-known healthcare providers and facilities that are commonly included in insurance networks include Mayo Clinic, Cleveland Clinic, Johns Hopkins Hospital, and Kaiser Permanente. These institutions are often recognized for their high-quality care and comprehensive services, making them desirable options for individuals seeking top-notch healthcare.Ending Remarks

In conclusion, the discussion on Employee Health Insurance vs Private Insurance: Which Is Better? highlights the key factors to consider when making this important decision, offering a nuanced perspective to help individuals navigate the complexities of insurance choices.

FAQ Explained

What are the key coverage differences between Employee Health Insurance and Private Insurance?

Employee Health Insurance is typically offered by employers with limited customization options, while Private Insurance allows for more flexibility in coverage choices.

How do premiums and deductibles vary between Employee Health Insurance and Private Insurance?

Employee Health Insurance often has lower premiums and deductibles compared to Private Insurance, but may have more restrictions on coverage.

Are pre-existing conditions covered differently in Employee Health Insurance and Private Insurance?

Private Insurance may have more comprehensive coverage for pre-existing conditions compared to many Employee Health Insurance plans.

What additional services like wellness programs and telemedicine are offered by insurance providers?

Private Insurance plans often include wellness programs and telemedicine services, while Employee Health Insurance may have limited offerings in this area.